Personal Loans

Cash flow shouldn’t be what holds you back

Starting life in Canada comes with unexpected costs. At Dohzy, we step in when you need short-term support, not because you lack income, but because you’ve hit a temporary cash gap. We’re here for those adjusting to life without their usual support system.

How Does It Work?

Our personal loans service is designed to help handle unexpected emergencies and manage cash flow up to $2,000. You can expect to receive your funds within 24 hours of your request!

Qualify for use

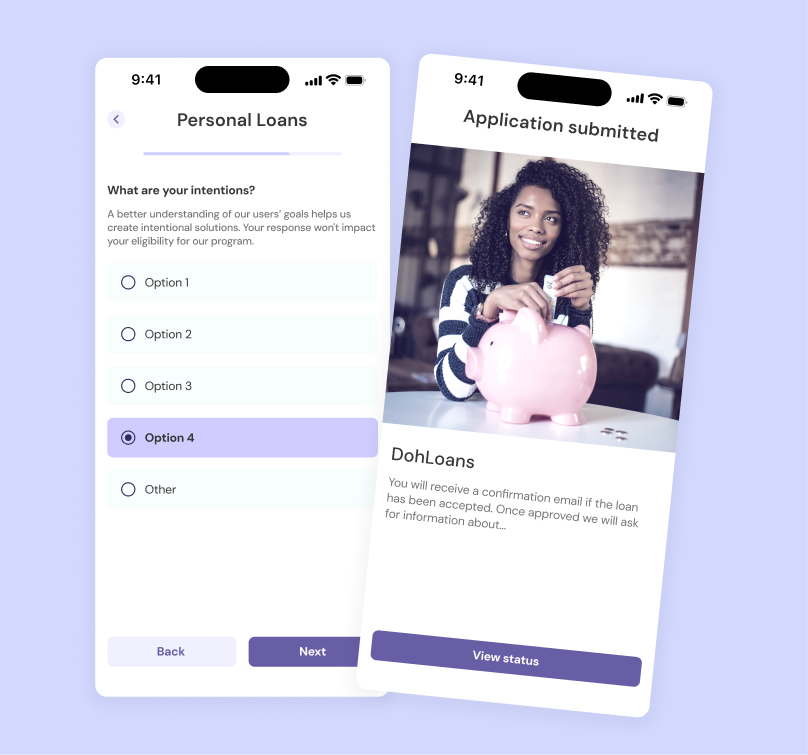

Complete our initial form to see if we are the best service provider for you. We’ll require a general understanding of your financial situation before you can continue further.

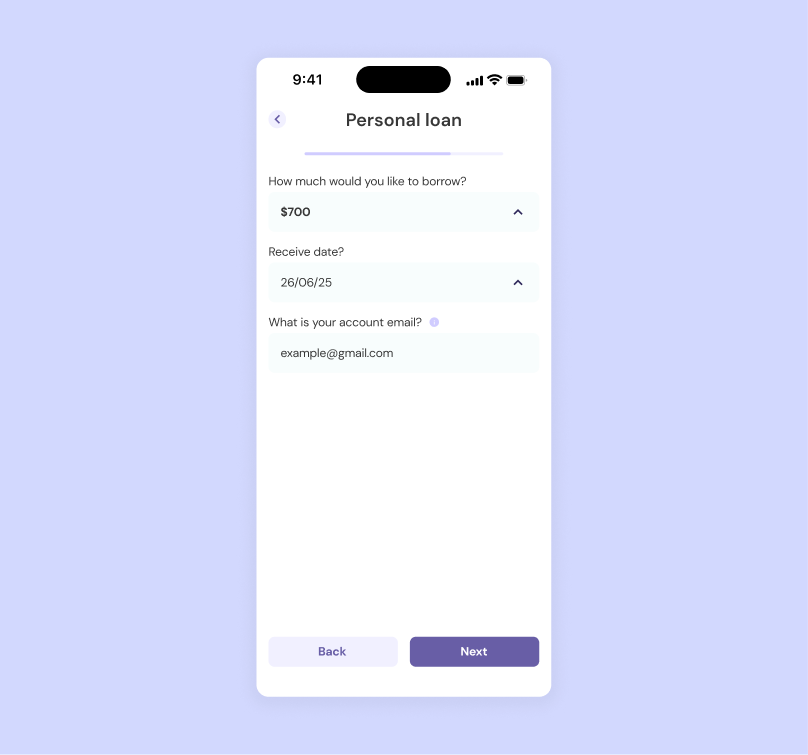

Submit your information on app

You will be required to download our new app and upload documentation needed to prove the initial information you’ve shared.

Request within your limit

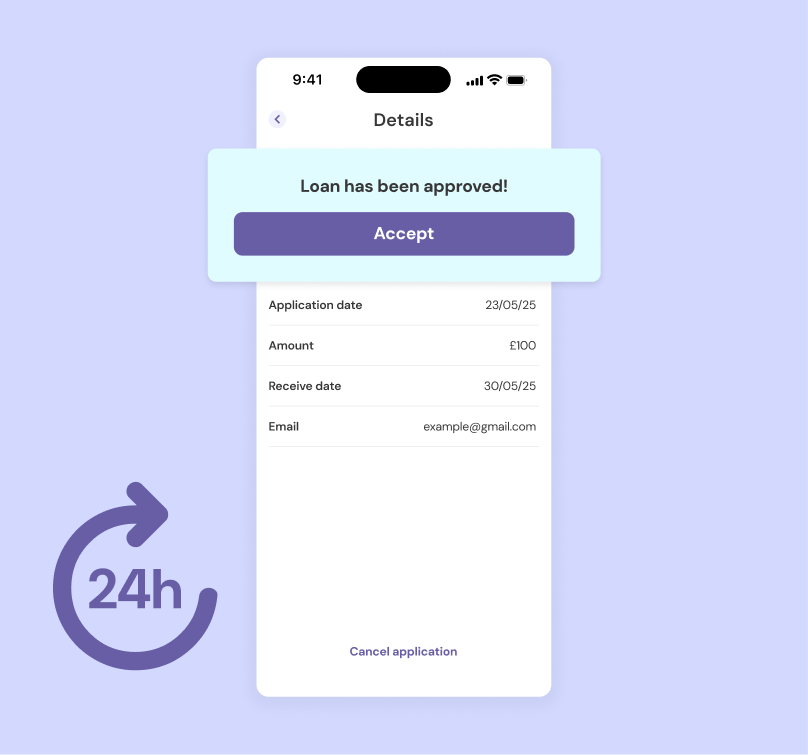

Within the app, once all is approved, we will inform you loan range you are entitled to. Here you can request the amount you need within the given range and expect to receive your loan within 24 hours!

Please note that in order to use this service you have to pay a one-time activation fee of $25.89

Why use Dohzy for your personal loan solutions?

Our Offers

Depending on your needs, we offer loans between $200 -$2000

Quick Response

We get back to you within 24hrs of your initial request

Low Interest

Anywhere between 10-19%, based on loan amount and duration

Speed

Users get an answer within 24 hours after a request and are told exactly when they should expect to receive.

Flexibility

Inclusivity

dohLoans FAQs

Our personal loans between $200 – $2,000. It usually starts at a smaller amount then the limit increases based on how well you use the system

- Automatic bank withdrawal

- interac eTransfer

- Send an interac eTransfer to [email protected] (Please note the password of the interac transfer)

- Log into to Dohzy and go to the “Repay Loan” page

- On the Repay Loans page, go to the loan in question and click on “Send the payment information”

- The system will collect your banking information during the loan application process

- the loan balance will be withdrawn from your bank account on the due date

Loan level 1: $100 – $200

Loan level 2: $100 – $300

Loan level 3: $100 – $500

Loan level 4: $100 – $700

Loan level 5: $100 – $1,000

Loan level 6: $100 – $1,500

Loan level 7: $100 – $1,800

Loan level 8: $100 – $2,000

There is a waiting period of : 1 Week before you can apply for another loan

- Dohzy Score

- Amount Requested

- Repayment installments

- Loan time frame

Yes. A credit check is done with the credit bureau upon a first loan request and it is done periodically when the user starts using the system. Please note that your permission will be requested before a credit check is done.